We have been using PayPal for online money transactions for the longest times known. There is no denying that it is the most popular payment service worldwide. It lets you send and receive the money quickly and easily using the registered email address. All you need to do is make sure both the parties have a functional PayPal account. In spite of its wide acceptance and immense popularity, you may still be looking for an alternative. This is because PayPal charges a high transaction fee and sometimes puts your payments on hold for no apparent reason. We catalogue the top 10 alternatives to PayPal in this article.

1. Skrill

Skrill isn’t as popular as PayPal but it is definitely one of its best alternatives. Just like PayPal, you can use this platform to receive and send money online. You can also shop online using Skrill. You could transfer the money from Skrill to your bank account instantly. You can thus use your debit or credit card to withdraw that money. You can also transfer the money to another Skrill user on their registered email address. Skrill was formerly known as Moneybookers. Over the years, Skrill has spread its wings and now boasts of a global presence.

Skrill also offers a prepaid MasterCard that allows you to do the offline shopping as well. Skrill is now being accepted by a wide range of merchants across the world. This payment service has lower transaction fees as compared to PayPal.

2. Google Wallet

As compared to the other online payment services, Google Wallet is relatively new. Just the fact that it is from Google is enough to make it popular. But, it does offer many features and functions giving you more reasons than just the name to use it. Currently, Google Wallet is available only in the USA and UK. But, it must be available in other countries very soon. Google Wallet makes online shopping and money transactions easier. You could save your credit/debit cards in the wallet, load money to it, and also send and receive money using the Wallet. Sending and receiving the money is easy. You just need the registered email address. It is also integrated to your Google account. Transaction charges are more or less the same as PayPal.

Trending : Best Malware Removal Software for Windows

3. Stripe

Strip isn’t a name a lot of people know. Although it is not as popular as PayPal, it is definitely one of its best alternatives. Strip is known for simplicity. It lets you send and receive the payments with incredible ease. You can accept the payment from the other Stripe user by giving them your registered email id. You can also take payments using the popular cards such as American Express, VISA, MasterCard, JCB etc. You could carry out the transactions in nearly 100 different currencies using Stripe. But, unlike PayPal, Stripe isn’t available in all the countries. Currently, its services are restricted to 19 countries only including the US, UK, Australia, and a few European countries such as France, Spain, Germany, and more. Stripe charges lower transaction fees to PayPal.

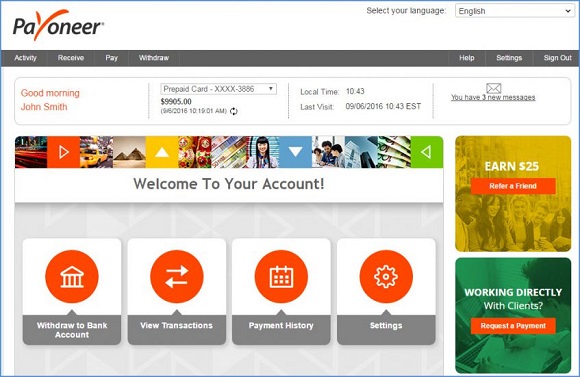

4. Payoneer

Payoneer is rapidly becoming the most preferred online payment transaction service among the online marketers, affiliate marketing professionals, and freelancers. No matter the country you are living in, you can use Payoneer to send and receive money. You can also add payment to your Payoneer account using bank transfer or debit/credit card. Payoneer also offers a prepaid credit card which you can use for offline, physical shopping. You can transfer the money to a bank account. You can also send the money to another Payoneer user. Payoneer is currently available in more than 200 countries and can process financial transactions in over 100 different currencies. Payoneer has high acceptance across various merchants around the globe. The transaction fees is also low as compared to PayPal.

5. 2Checkout

If you are looking for a PayPal alternative which can mirror almost all its services, 2CheckOut is definitely not the perfect choice for you. One of the biggest reasons why it is not as similar to PayPal is because it does not let you transfer money to the other 2Checkout users. But, as the name suggests, it is a great alternative for online shopping. A large number of merchants allow you to make the payment using this payment service. 2Checkout also supports a wide range of transaction methods including MasterCard, Visa, JCB and even PayPal. This service supports nearly 30 currencies and integrates well with a variety of shopping portals such as 3DCard, Shopify and more. The transaction charges are low if you are from the United States. But, they could be as high as 5.5% in other countries.

Might be Interesting : Top 10 Amazon Fire TV Apps for Media Streamers

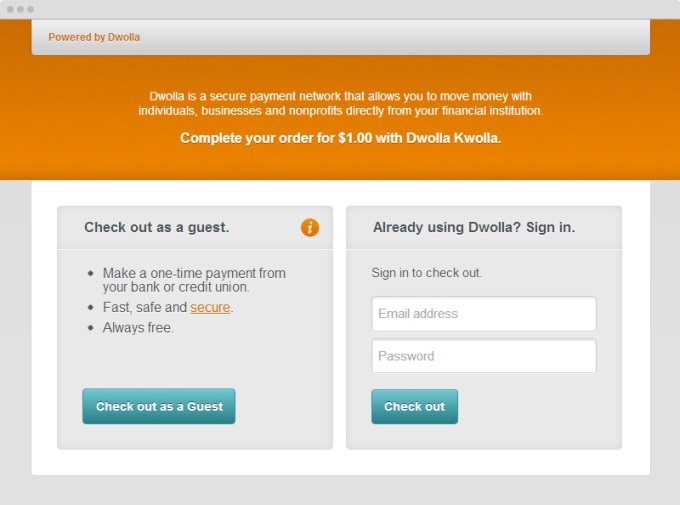

6. Dwolla

Dwolla is another incredible alternative to PayPal. It is an easy to use payment service that lets you send and receive money. Dwolla can also be used for making the payments for online shopping. If you happen to own a business, you can use Dwolla for money transfers. One of the most unique things about Dwolla is that it allows money transfer in various ways. You could send the money to an email address (just like PayPal). At the same time, you can transfer the funds to the Twitter followers as well as LinkedIn connections. It also lets you send the money to phone numbers. Dwolla is a great choice for businesses in many ways. For starters, it offers a feature called MassPay that lets you process large number of payments simultaneously.

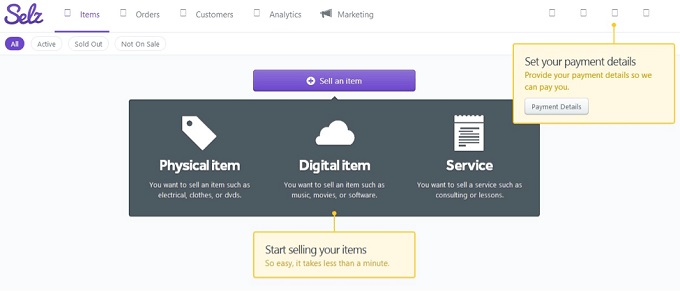

7. Selz

If you are a freelancer who needs to take payments from international or local clients, Selz could be the perfect payment method for you. Even if you own a small business, you could enjoy many benefits this payment service has to offer. You can also integrate the Selz service to your website to accept payments. In fact, WordPress hosting platform offers a dedicated Selz plugin for this purpose. Selz lets you transfer the money directly to your bank account. You can also send the money to PayPal. Selz charges a 5% fee and an additional $0.25 per transaction. PayPal is available in over 190 countries at this time. Selz may not be the most viable PayPal alternative in all respects, but it is suited well for small level of digital transactions.

Check : Best Game Recording Software for Windows PC (Free & Paid)

8. WePay

If you want to give more ease of payment to the customers when they purchase something from your site, you would like to use WePay. It allows your customers to make the payment without having to leave your website. But, this does not mean WePay isn’t safe. In order to accept the payments, it creates a virtual terminal on your site. WePay isn’t as easy to implement as the others on this list. It is an API-based payment system and thus requires certain level of technical knowhow. But, once implemented, it could be one of the easiest and simplest services to use. WePay easily accepts almost all the international credit and debit cards. However, it is available only in the United States and you must have the Social Security Number in order to use it.

9. Square

Square isn’t truly your conventional alternative to PayPal. Yes, it does allow you to accept payments and update them in your account. But, it works differently. When you subscribe to Square’s services, you are provided a credit/debit card reader which you can attach to your smartphones including Android, iPhone and more. This lets you accept the payments from the people in person. You can also use your own credit card to upload the payment to account. You can also quickly set up an online store using Square from where your potential buyers can buy the products using their credit/debit card. Square also accepts payments from Apple Pay. It charges a fee of 2.75% for every transaction and is available only in the United States and Canada.

10. Amazon Payments

Amazon has come up with its own payment system and by all means it is a great alternative to PayPal. It offers you the platform for all kinds of online financial transactions. It also offers different payment services to suit the needs of different kinds of users such as individuals, businesses, customers, and developers. You could easily add a payment method to your account. In fact, it uses the payment methods you have integrated to your Amazon.com profile. Amazon Payments is available only to the residents of the United States at this time.